In the realm of financial planning, selecting the best term life insurance is a pivotal decision that can safeguard your family’s future.

The market offers a myriad of options, making the choice seem daunting. However, fear not, as this article unravels the complexities and guides you through the key considerations in choosing the best term life insurance.

Discover the peace of mind that comes with a well-informed decision as we explore the factors that matter most in securing the ideal coverage for you and your loved ones.

Understanding Term Life Insurance

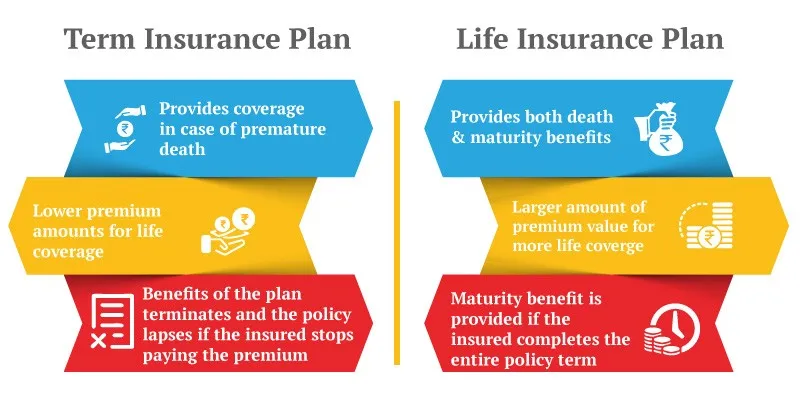

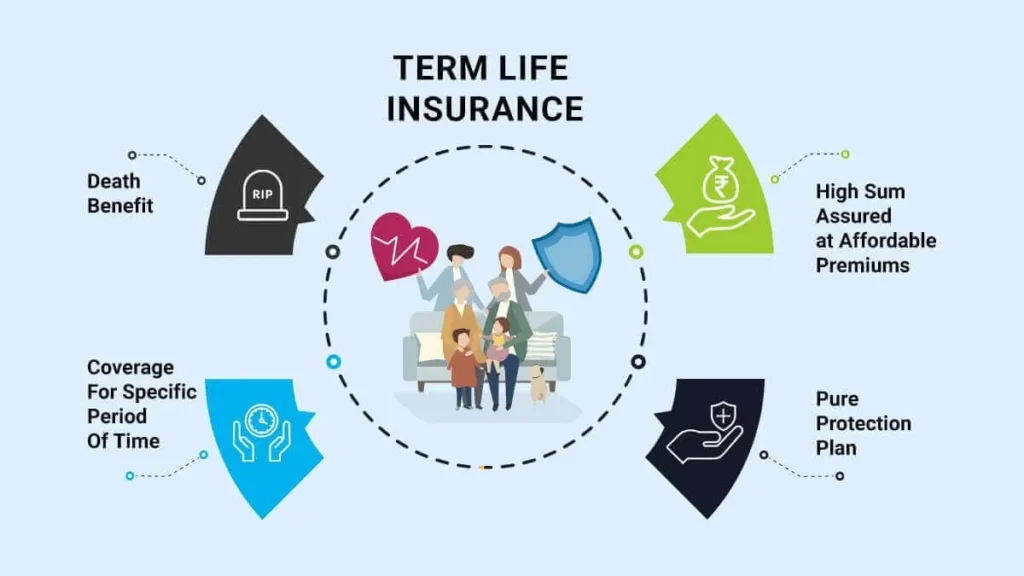

Term Life Insurance is a straightforward and temporary form of life insurance coverage. It provides financial protection for a specified period, or “term,” usually ranging from 10 to 30 years.

During this period, if the insured person passes away, the policy pays out a death benefit to the designated beneficiaries.

Unlike whole life insurance, term life insurance doesn’t accumulate cash value over time. Instead, it focuses on providing a death benefit to support dependents in the event of the policyholder’s untimely demise.

This type of insurance is often chosen for its affordability and simplicity, offering a cost-effective way to ensure financial security for loved ones during critical life stages.

Tips to Choose the Best Term Insurance

Choosing the best term insurance in India is a crucial decision that requires careful consideration. Here are some tips to help you navigate the process and make an informed choice:

1. Assess Your Coverage Needs:

Evaluate your financial responsibilities and the needs of your dependents. Consider factors such as outstanding loans, future education expenses, and daily living costs to determine the appropriate coverage amount.

2. Policy Duration:

Select a term that aligns with your financial obligations. It could be until your children finish their education or until your mortgage is paid off. Avoid underestimating the duration, as it’s essential to have coverage during critical life stages.

3. Compare Premiums:

Get quotes from multiple insurance providers to compare premium rates. Look for a balance between affordability and the coverage offered. Online insurance aggregators can be useful for comparing prices easily.

4. Claim Settlement Ratio:

Check the claim settlement ratio of the insurance company. This ratio reflects the percentage of claims settled against the total filed. Opt for insurers with a higher ratio, indicating a smoother and more reliable claims process.

5. Riders and Add-ons:

Explore the additional benefits or riders offered by insurers. Common riders include accidental death, critical illness, and disability riders. Choose riders that align with your specific needs to enhance your coverage.

6. Financial Stability of the Insurer:

Assess the financial stability and reputation of the insurance company. A well-established and financially secure insurer is more likely to fulfill its commitments over the policy term.

7. Policy Exclusions:

Carefully read and understand the policy exclusions. Be aware of situations or conditions not covered by the policy to avoid surprises during claims. Transparent communication from the insurer is crucial.

8. Medical Check-up:

Be honest during the medical underwriting process. A thorough health check-up ensures that your policy is priced correctly, and there are no disputes during the claim settlement process.

9. Customer Reviews:

Research customer reviews and testimonials about the insurer’s services. This can provide insights into the customer experience, including the ease of the buying process and the efficiency of the claims settlement process.

10. Seek Professional Advice:

If needed, consult with a financial advisor or insurance expert. They can help you understand the nuances of different policies and tailor the coverage to meet your specific requirements.

By following these tips, you can navigate the process of selecting the best term insurance in India, ensuring that you make a well-informed decision that aligns with your financial goals and provides security for your loved ones.

Must Read: How to Get Loans Without Credit Checks

Compare the Costs and Benefits of a Term Life Insurance Plan

When considering a term insurance plan, it’s essential to weigh both the costs and benefits to make an informed decision.

Here’s a comparison of the costs and benefits associated with a term plan:

Costs:

1. Premium Payments:

Term insurance plans generally have lower premium payments compared to other types of life insurance, making them an affordable option for many individuals.

2. No Cash Value Accumulation:

Unlike some other life insurance policies, term plans do not accumulate cash value over time. This means that if you survive the policy term, you won’t receive any maturity benefits or returns on the premiums paid.

3. Increasing Premiums with Age:

In some cases, the premiums for term plans may increase with age, especially if you choose a renewable term policy. It’s essential to be aware of this potential increase when budgeting for your insurance needs.

Benefits:

1. Death Benefit:

The primary benefit of a term plan is the death benefit. If the insured passes away during the policy term, the beneficiaries receive a lump sum payout. This amount can be crucial in providing financial support to dependents, covering outstanding debts, and maintaining their standard of living.

2. Affordability:

Term plans are known for their affordability, allowing individuals to secure substantial coverage at a relatively low cost. This makes it a practical choice for those with budget constraints.

3. Customizable Coverage:

Term plans often offer flexibility in choosing the coverage amount and policy duration based on individual needs. This customization allows policyholders to align their coverage with specific financial responsibilities and obligations.

4. Tax Benefits:

Premiums paid towards a term insurance plan are eligible for tax benefits under Section 80C of the Income Tax Act. Additionally, the death benefit received by the beneficiaries is usually tax-free under Section 10(10D).

5. Financial Security:

Term insurance provides peace of mind by offering financial security to your loved ones in case of your untimely demise. It ensures that your family can maintain their lifestyle, repay debts, and meet other financial obligations without undue hardship.

6. Convertible Options:

Some term plans come with the option to convert to a permanent life insurance policy later on without the need for a new medical examination. This can be beneficial if your financial situation evolves, and you desire a different type of coverage in the future.

Best Term Insurance Plans in India

Before making a decision, carefully compare the features, coverage, and premium rates of different term life insurance plans offered by these companies.

Additionally, consider factors such as the claim settlement ratio, customer reviews, and any specific riders or additional benefits that may be important to you.

It’s also recommended to consult with a financial advisor to tailor the plan to your specific needs and circumstances.

- ICICI Prudential Life Insurance

- HDFC Life Insurance

- Max Life Insurance

- SBI Life Insurance

- LIC (Life Insurance Corporation of India)

- Kotak Mahindra Life Insurance

- Reliance Nippon Life Insurance

- Bajaj Allianz Life Insurance

- TATA AIA Life Insurance

- Aviva Life Insurance

Conclusion

In conclusion, selecting the best term life insurance plan in India demands thoughtful consideration of individual needs, financial goals, and the reputation of insurance providers.

Evaluate each plan’s features, premium affordability, and additional benefits. Keep abreast of the dynamic insurance landscape for the latest offerings.

Consulting with financial experts and staying informed ensures a well-informed decision, providing the necessary financial security for your loved ones in times of need.